The first fund in Vietnam to focus uniquely on investing in private companies

Seeing the opportunity to set up the first fund in Vietnam to focus uniquely on investing in private companies, Mekong Capital launched the Mekong Enterprise Fund (MEF) in 2002 at US$18.5 million in committed capital.

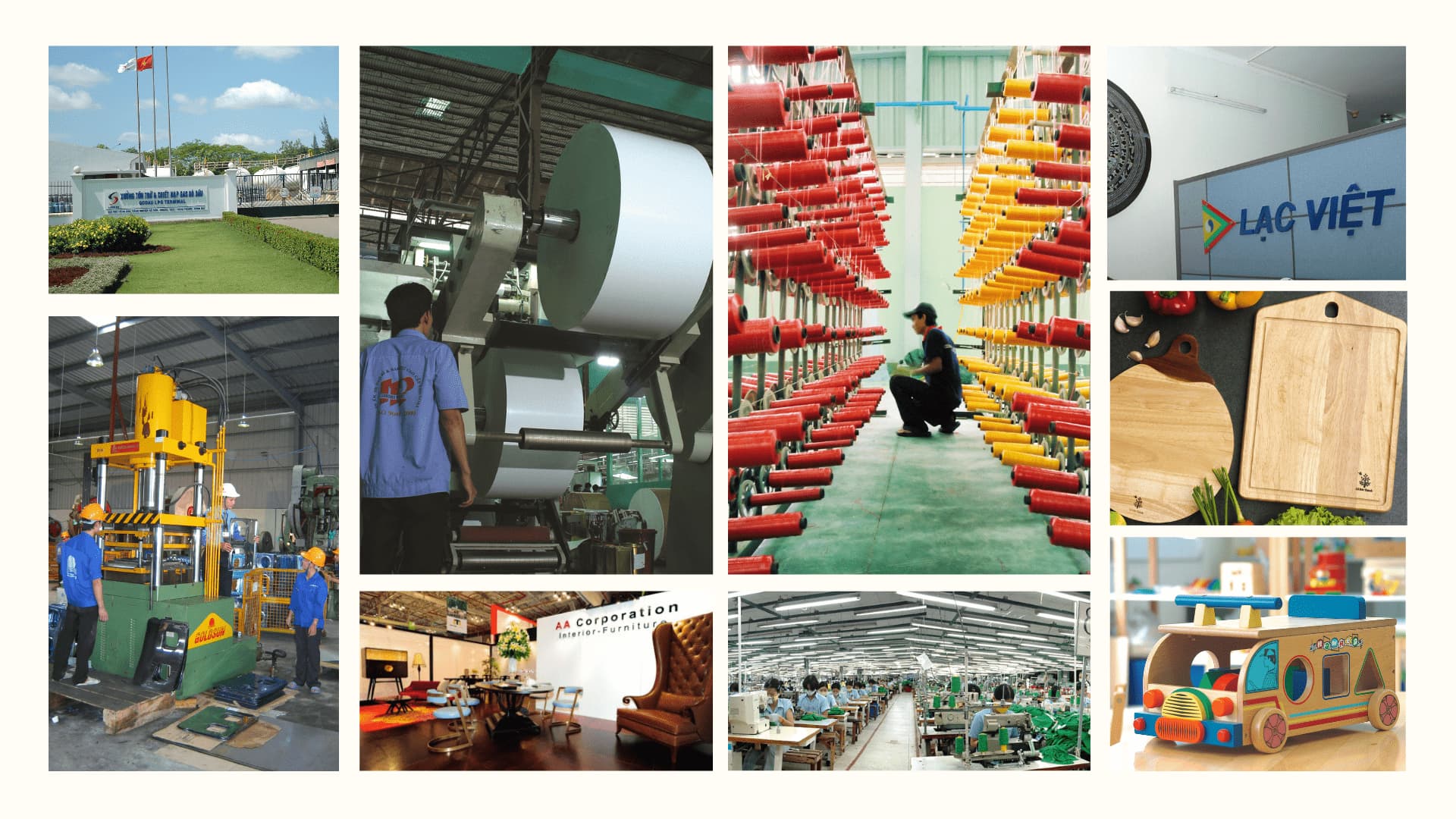

MEF was fully invested in 10 companies by the end of 2005. We expected that our investments would be in private companies that would emerge as the leading private companies in Vietnam. Due to their fast growth, they would overtake SOEs to become the largest companies in Vietnam within ten years.

However, for the first five years, Mekong Capital made an ongoing series of mistakes and didn’t get many things right. MEF invested mainly in family-owned businesses managed by first-generation Vietnamese entrepreneurs, which proved very difficult to change or build up their management team.

Furthermore, MEF pursued smaller-sized companies with significant exposure to manufacturing and export-related industries. These industries were cyclical and proved difficult to capture much shareholder value given that they typically didn’t own anything of strategic value (like a brand, a distribution channel, intellectual property, and others).