Our journey began with a mission

The 1990s saw several funds launched in Vietnam that invested in joint ventures with state owned enterprises or former state owned companies that had been “equitized”. Occasionally these funds would invest into a foreign owned business in Vietnam or a private company. One of these funds was the NYSE-listed Templeton Vietnam Opportunities Fund, where the founder of Mekong Capital, Chris Freund, started his career in 1995. These funds weren’t particularly successful and only one of them, Dragon Capital’s Vietnam Enterprise Investments Limited (VEIL) continued to operate by the year 2000.

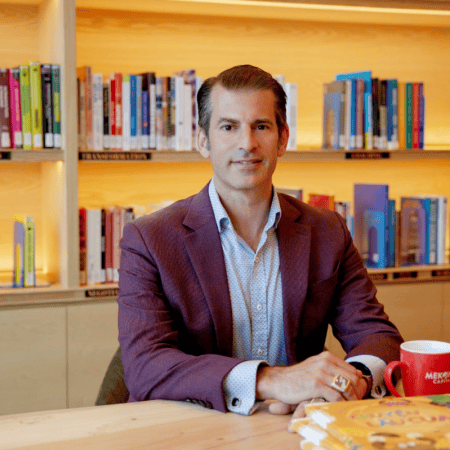

Mekong Capital was founded by Chris Freund in 2001 as the first fund manager in Vietnam to focus uniquely on investing in private Vietnamese companies and to take a very active approach in adding value to our investee companies. Chris launched Mekong in close partnership with the Mekong Project Development Facility (MPDF), a World Bank program with a mandate to catalyze the development of the private sector in the Greater Mekong Sub-Region. One of the donors to the MPDF, the Asian Development Bank (ADB), became a champion for the launch of a fund that would invest into private SMEs in Vietnam, Cambodia and Laos. ADB would eventually become the anchor investor for Mekong Capital’s first fund, Mekong Enterprise Fund.

At the time, the only other fund actively investing in Vietnam was focused on investing in former State Owned Enterprises that had been equitized, rather than companies in Vietnam’s private sector.

For more on the early history of Mekong Capital, please see: The Origin of Mekong Capital