The World of Ontological Private Equity

Author: Chris Freund, Founder and Partner, Mekong Capital

Mar 2, 2020

——

“You cannot teach a man anything, you can only help him discover it within himself. -Galileo Galilei”

How many times have you met with a CEO who knew that something wasn’t working in her company, but she wasn’t taking action to find out what the source was to then do something about it? How many times have you prepared an excellent plan for a company and offered it to them, but once in their hands, the project was quickly forgotten? How many times have you presented your excellent ideas to the CEO at the Board meeting, but no action to implement your ideas were taken? If you are an investor, like us, you have been right there in the middle of one, or even all these scenarios. Many times.

We have undergone an evolution in our thinking, an evolution that has allowed us to discover [1] what works to generate performance in the world of Private Equity, a way of approaching these same scenarios that is called an “ontological approach”. By ontological, I mean the nature of being for human beings, and more specifically life as actually experienced by human beings, subjectively how it occurs for us and how we interact with life in each moment. To be clear, I do not mean ontological as a concept or description of an experience, but rather it points to the lived experience of a person in the present moment as it occurs for them.

Common sense didn’t work

In 2002, one of our first investments was a plastics packaging business. There was so much low-hanging fruit; international best practices were unknown to them, providing us with what appeared to be a great opportunity to introduce our great ideas to them.

One of our great ideas was to provide them with clear job descriptions — we thought they would learn from those and then apply similar standards themselves in the future. At first, they did what we wanted, and they tried the new job descriptions for two weeks. But then they reverted to what they had been doing prior. We were having no impact.

Another great idea was to tell them they should hire someone with more expertise and higher standards in Quality Control (QC), but it didn’t happen. Later, they had all kinds of problems when their products didn’t meet the customers’ specifications. Another great idea was to suggest that they improve their website and implement search engine optimization, but it didn’t happen. Another great idea was to urge them to apply a performance-based bonus system. Still, the Chairman preferred to personally decide each employee’s bonus and personally give a cash bonus to each employee in an envelope at the end of the year. Ultimately, the company just kept doing what it was doing before we had invested. We were having no impact.

This story wasn’t only about this one plastics company, but this same pattern played out consistently across Mekong Capital’s portfolio of ten investments in our first fund in 2002–2005. We were going to Board meetings and giving them useful suggestions. We were e-mailing them our ideas. We were meeting them and trying to tell them what they should do. We thought we knew “best practices”, and we were going around saying “you should do this” and “you should do that,” and it all seemed to be common sense. We were having no impact.

This appeared to be entirely counter-intuitive. The companies we worked with often agreed with the correctness and value of what we shared. Intellectually, they knew it was good advice. Yet when faced with what they were dealing with day-to-day, they kept reverting to their past patterns of behavior in line with the way things occurred for them, or they got stopped by their concerns and reasons not to try something new. The take-away insight here was that giving them knowledge and solutions was clearly not enough.

How many times has this happened to you, and you were frustrated and stuck, unable to impact an investee company, not knowing what to do or how to advance that investee company?

Chris Freund is in a meeting with our investee company and deal team.

Being with an uncomfortable truth

We had to face an enormously simple fact that was nevertheless the one thing we did not want to hear: since this was happening across our entire portfolio, it became evident that something about us was the source of these patterns of behavior. Getting clear about this, we began to take a careful look at what was not working, while also assessing what did work. What was different about those cases that worked?

This essential soul searching started for me in 2007. I had been involved with investing in Vietnam since 1995, and had been one of a small group of people in Vietnam with the most Vietnam investment experience since the U.S. led trade embargo was lifted in 1994. In 2007, I thought of myself as a person who had a high awareness of business best practices and the investment landscape of Vietnam. I thought of our investee companies as not having much exposure to the modern business world — so my perspective was something like, “I know more than you, and I’m here to help you.” And sometimes, I felt impatient like we needed to get things done quickly and it would just be faster and easier to try to solve the companies’ problems for them. I wanted to give them answers, solve their problems for them, and if they would just follow my advice, I was sure they would be successful.

I realized I must have occurred to our investee companies as an outsider who didn’t understand what they were dealing with, who kept proposing solutions which weren’t relevant to whatever obstacles they were facing, and who was sometimes talking down to them. And when I did have an unusually good idea, normally they had some concern or reason why they couldn’t apply it. I had to accept the realization that what I was doing, and what Mekong Capital was doing, wasn’t working.

Discovering self-discovery

In 2008, we started to experiment with inviting the founders and senior management of our investee companies like MobileWorld and Golden Gate to create their own vision of their company’s future. We discovered that when they did so, they owned this vision as their own and could see themselves in the future they created. It wasn’t someone else’s idea that was imposed on them. When they owned it as their own, and it was alive for them, they proactively provided leadership and took actions for the fulfillment of their future. It became easy for us to be a partner with them, a partner who was committed to the fulfillment of a shared future.

We also noticed that some companies were much more successful than others in building their corporate cultures. Unsuccessful companies would create a set of core values, circulate them by e-mail, post it on the wall, and everyone would ignore what was written. Successful companies found ways to cause their team to practice the core values in their daily work, through assignments or projects. Those employees struggled to apply the core values at first, but in doing so, they discovered for themselves what it is to apply those values, saw that it works and how it works, then ultimately owned those core values as their own.

Pizza 4P’s is Vietnam’s most popular restaurant chain, with a network of 19 restaurants so crowded they must turn away up to 1,000 customers per day. One of Pizza 4P’s core values is Omotenashi, which means “unconditionally incredible hospitality.” Their intention is that every customer will have a “Wow” experience, will be surprised by the exceptional quality of the food, will be delighted with the incredible service delivered within a peaceful environment.

Originally, Omotenashi was merely an intention of the founders, Masuko and Sanae. The severs knew this was one of the company’s core values, but they struggled to apply the service standards that Masuko and Sanae expected. It occurred for Masuko and Sanae that the only way to ensure their service standards were fulfilled was for the two of them to be personally involved in all aspects of the company’s operations, including each of the restaurants. This led to them working 18 hours per day, and it wasn’t sustainable.

When Mekong Capital first invested into Pizza 4P’s, it was Masuko’s and Sanae’s top priority to improve the customer experience and maintain high standards for all customers. So they launched a project in which each restaurant had a daily summary report to capture customer complaints or feedback, so the team could quickly respond and take remedial actions accordingly.

With this new system, the team had easier access to consistently delivering “Wow” moments to its customers every day. A tsunami of Omotenashi was unleashed. The senior management started communicating about Omotenashi in every internal conversation and referring to Omotenashi in every management decision. Then the restaurant managers started to inspire the staff to try and practice Omotenashi, challenging them to find ways to delight customers and deliver a Wow experience. For example, making an unexpected special celebration when it was a customer’s birthday or going out of their way to anticipate the needs of a new mother who was taking care of her baby. By consistently practicing this core value, each restaurant staff that discovered for themselves what it was like to delight customers, made it easier for that staff to do it again and again.

There was a system for sharing these stories of delighting customers with each other, giving others new inspiration and inspiring more staff to give it a try. In this way, it became a self-reinforcing loop, and the Pizza 4P’s team now is constantly practicing and rediscovering for themselves what it is to deliver unconditionally incredible hospitality to their customers. With the team living the core value of Omotenashi, it provided Masuko and Sanae to focus their attention on growing the business and achieving their vision.

The ontological phenomenon

The pattern that became more and more clear was that whenever our investee companies were making real sustainable progress towards achieving their vision, it kept coming back to who these people were being, especially new ways of being they had created, not simply new information they had available. When someone had discovered something from their personal experience, it wasn’t just a theory or idea, but rather they had the first-person experience of doing that thing or getting it as a possibility, a new way to see and interact with the world they are directly engaged with. This could be a CEO discovering for herself a new dimension of what it is to be a leader by trying on something new, experiencing what it is like to do that, and have it work. Or it could be the senior leadership team creating the company’s vision, and the vision becomes alive for them and is present in their speaking. Or it could be a senior manager practicing listening in a new way, until it worked and she discovered for herself something new about what it takes to listen authentically.

In these examples, the person is experiencing themselves being in a world that gives them openings and access to new actions which will fulfill whatever that person is committed to. For example, when employees merely know a company’s vision, it is “aspirational”, which means it is a good idea intended to “motivate” people, but it is out there floating in space-time, like something we intend to get to later, and there is no authentic reliable intention to really achieve it starting in the present moment. But when they are being the vision, they are experiencing the world of that vision and committed to it. Then they will have lots of freedom to move within the world of that vision and will take actions that are consistent with the fulfillment of that vision. This is the world of Ontological Private Equity.

When people are creating a new world, like a vision, for example, they are concurrently creating possibilities that arise together with what they are creating. By possibilities, I mean a state of being in which exciting outcomes are possible, and there are opportunities for taking action that would fulfill those outcomes. Rather than the hopelessness of having no way forward, a world full of possibilities is a way of seeing things in which they are openings for new actions. As a vivid example of this, when Martin Luther King Jr. gave his “I have been to the mountaintop” speech, he is declaring a vision for the future. Who he is being is that the future is alive for him in the present as achievable, full of possibilities and there are clear openings to take action to deliver that future.

What it looks like to discover for oneself

In Private Equity, we are in the business of investing in companies and partnering with them to take actions to achieve breakthrough performance and fulfill their long-term vision or goals. We ultimately discovered that no amount of great ideas, solutions, telling them what to do, or forcing them to do something, has had any impact on their performance. In fact, if something is spoken of as “Mekong Capital’s idea,” we know that that is code for their not having discovered it for themselves, and consequently, they don’t own it and they don’t see it as a possibility. As long as members of an investee company haven’t yet discovered and then created for themselves what works for them out of our coaching, we have work to do. We are coming from a place where we see ourselves as responsible that our investee companies discover for themselves and experience for themselves what works for them. This is the world of Ontological Private Equity.

In 2007, we invested in a jewelry retail chain called Phu Nhuan Jewelry (PNJ), which had around 30 stores at the time, and it grew very well into a strong brand which today has more than 350 jewelry stores. Based on our good experience with PNJ, we thought we had a clear idea of what it takes to invest successfully in jewelry retail in Vietnam.

In 2016, we sold our investment in PNJ, and we invested in a much smaller chain called Ben Thanh Jewelry (BTJ) that only had 4 locations when we invested. We thought we knew what to do, so we recruited a management team and started sharing our ideas with them. From the very start of our investment in BTJ, the company faced one crisis after the next. There was always a strong sense of urgency. Given the sense of urgency, we often resorted to giving the management solutions and telling them what to do based on what we knew — for example, telling them how to improve their merchandising or how to run their digital marketing. Sometimes, the management would go through the motions of doing what we had instructed, but most of our ideas were not successfully executed. Later, we would hear them refer to these initiatives as “Mekong Capital’s ideas” or they were only doing something because “Mekong Capital wanted it”. BTJ turned out to be our worst-performing investment in the last 10 years.

F88 is a title lending businesses, making small loans to individuals using the ownership certificates of vehicles as collateral. In 2018, the typical waiting time for customers to receive a loan from F88 was 3 hours: the customer would have to wait in the store while the company conducted background checks, completed the paperwork, got agreements notarized, etc. This was unpleasant for customers and we all knew it.

Rather than trying to solve the issue for F88, we encouraged F88 to apply an Agile framework to identify ways to shorten the waiting time for customers. F88 set up a cross-functional team for this project and they immersed themselves in the world of reducing customer waiting times. Every week, they generated lots of their own ideas, ran some small tests, and when something worked they quickly rolled it out across their whole store network. Week-by-week, the performance improved, and the waiting was ultimately reduced to less than 30 minutes. This led to a huge growth in their loan balances and revenues per store. These were all ideas generated, tested and implemented by F88. They owned whatever they discovered, and it was natural for them to roll these discoveries out to their whole store network.

F88 provides personal financial services with branches throughout all provinces and cities of Vietnam.

Knowledge is the map, not the territory. Being is the territory.

Knowing vs being is the difference between the 3rd person experience of watching a football match and describing what’s happening versus the 1st person experience of being on the field and interacting with the other players and discovering what it actually takes for the team to score a goal. As an observer, you can know all of the rules, every strategy, and tactic that various teams have used; you can know all of the stats and the players and their strengths and tendencies. These are generalizations and conceptual representations in one’s mind. But that knowledge, including any tactical plans for the players, won’t become successful performance until a person has practiced and discovered ways of looking at things and interacting with things in real-time as a player on the field that leads to successful performance. What is the experience, and ways of looking at things, of playing that game successfully on the field?

Being is the space, shaped by occurring, in which people interact with the world. Who a person is being will be correlated with what actions they take, and will ultimately lead to their success or failure. This is why we distinguish our approach as “ontological” in nature — while we don’t negate the value of knowledge and its acquisition, we assert that who people and organizations are being is essential to producing breakthroughs in performance, and an ontological approach gives us access to impacting the ability of people and organizations to achieve their long-term goals.

When we first invested in F88 in 2015, the 3 co-founders tended to delegate almost everything, but they weren’t holding those people accountable and rarely communicated with their teams. They had not run a large business before and didn’t have a clear picture of what it looks like to manage and lead a fast-growing company. We were giving them lots of ideas about how they should visit the stores more and hold people accountable more. We were sharing with them lots of our knowledge. It was like we were trying to teach them. But they weren’t doing what we were telling them, and we weren’t impacting their performance. During the first year of our investment, F88 wasn’t yet achieving its targets.

The next year, we organized a 9-month leadership coaching workshop, which most of our investee companies chose to join. F88 sent its 5 most senior people to join this workshop. During the workshop, the co-founder/CEO, Tuan, was given various leadership assignments, including communicating openly with his management team, confronting the under-performing managers, and acknowledging people’s achievements. These were uncomfortable conversations he had never had before, but step-by-step, he moved out of his comfort zone and did the assignments. As a result of his directly communicating with his teams, he began to deal with people who weren’t doing their jobs and reallocated the accountabilities of the senior team based on each person’s strengths, and this helped to de-bottleneck the company. Every time he had one of these new conversations, and it worked, he had created a new way of being that would always be available to him again in the future.

Phung Anh Tuan, Co-founder and CEO of F88

Tuan emerged as the living embodiment of the new culture inside of F88. When the team saw their CEO being a model of the new culture, they began to choose to try it out for themselves. In this way, the new culture gradually cascaded down throughout the company.

By the end of that program, Tuan emerged as a strong leader and realized that by transforming his own leadership and the company culture, he became the source of F88 achieving its vision. Since that time, F88 has grown its loan balance by more than 10 times, has tripled its number of stores, and has emerged as Vietnam’s #1 company in its sector. None of this was the result of what Tuan knew to do or what we told him to do, but rather what he discovered for himself and who he was being. This is the world of Ontological Private Equity.

Where the rubber meets the road

There is nothing wrong with knowledge, with acquiring knowledge appropriate to one’s business: knowledge is critical to getting one’s job done. However, knowing something does not grant us access to performance, to doing it, being it, or getting it as an experience of how we interact with the world that can be repeated.

Just to be clear, we are big advocates of using facts and data-based decision-making to lead to breakthroughs in performance. Nothing in the ontological approach diminishes the value of facts and data. On the contrary, when we can relate to those facts from the world of being, it will give us access to interacting with those facts and taking action, which just isn’t possible when we are simply relating to those facts through what we already know or someone else’s knowledge. The ontological approach simply acknowledges that we each have our own ways of being and our subjective ways of perceiving whatever is going on, which will dictate our relationship to any facts and data.

As human beings, real-life happens in terms of how we perceive things (phenomenology) and who we are being (ontology): How does the situation occur for you? What is going on for you internally? Who are you being in this situation? In terms of where your consciousness meets the outside world, what is it actually like to do something that works, or even develop mastery in something? This is the difference between reading instructions about how to tie your shoes and being able to tie your shoes. It is when you know the experience of doing it, as the way of interacting with your shoestrings to tie your shoes, NOT that you’ve memorized a set of instructions that you could describe to someone else [2].

Being and Private Equity

We ultimately discovered for ourselves that people take action based on how things occur for them, including how they experience things and what is going on for them internally, which is not the same as what they know. The world of being is when someone discovers or creates something for themselves and it exists for them as their own experience. It’s the space in which life happens, in which people connect their being to whatever they are dealing with in the world and the space from which they generate new actions. A person’s occurring shapes their experience of being. For example, if something occurs possible, a person will take actions consistent with that, but if something occurs as not possible, the person will take no action.

In Daniel Pink’s book Drive: The Surprising Truth About What Motivates Us, he presents extensive research indicating that human motivation arises from intrinsic elements (inner experience), rather than extrinsic (external rewards and punishments). He presents that those intrinsic motivators can be categorized into 3 areas: Autonomy, Mastery, and Purpose. Autonomy is a state of freedom and choice. Mastery is the pull to get better and better at something until it becomes one’s natural self-expression. The purpose is a commitment to fulfill something much bigger than one’s self. What’s notable here is that these are all states of being, rather than knowledge. While there are other ways to categorize what states of being that give rise to people taking action, what is notable here is that knowledge alone doesn’t cause people to take action.

This is critical in Private Equity. Because a core success driver in Private Equity is our ability to add value to investee companies, meaning that they more reliably achieve their goals, or they achieve bigger goals, as a result of our involvement. For Mekong Capital, rather than giving them solutions or doing their work for them, it’s our ability to bring our investee companies to see themselves and what they are dealing with in ways that invite them to take new actions that lead to breakthroughs in their performance. This will ultimately lead to achieving their long-term goals given by their vision for the future of their company. As Benjamin Zander said in his book The Art of Possibility, “The conductor of an orchestra does not make a sound… His true power derives from his ability to make other people powerful.”

Is our investee companies’ vision alive for them as their own, and are they proactively taking actions to fulfill their vision? Are they being their core values and taking actions that are an expression of those core values? Are they proactively and independently building up their management team, not because we are pressuring them to do so, but because they have discovered the importance of upgrading their team to fulfill their vision? The answer to these questions will be “yes” when they have the empty space to discover for themselves and make their own choices, and when the way that things occur for them is well aligned with the fulfillment of their company’s vision. This is the world of Ontological Private Equity.

Unleashing the superpowers

Thi is the founder and CEO of ABA Cooltrans, a very fast-growing cold chain logistics company that serves most of the large grocery retail chains in Vietnam. Originally a family business, there was a strong culture of loyalty and trust, but not necessarily performance. ABA was growing fast but tended to have a lot of unexpected crises, which sometimes threatened to interfere in ABA’s ability to honor their commitments to their customers. ABA’s customers depend on reliable on-time delivery of the right items at the right temperature every single day. We realized that the CEO had too much on his plate and didn’t have a clear job description, so we requested that Thi create a clear job description for the CEO role.

The first version of the job description was a template of a CEO job description that seemed like it was downloaded from the internet. The contents were quite irrelevant to what ABA was dealing with. Reviewing it together, we quickly threw it out. Then starting with the company’s vision and its core values, Thi started to create the job description himself based on what ABA needed. He revised it, fine-tuned it, revised it some more, gave some feedback about what was missing, and he revised it some more, and so on. Eventually, Thi fully owned the role of the CEO, had a very clear picture of what an effective CEO looks like, and was clear what had been missing at ABA until then.

He had created for himself the whole world of what it is to be an excellent CEO for ABA. His occurring had shifted, and there was no turning back. Immediately after that, Thi started taking new actions he hadn’t taken before, such as terminating some long-time employees who weren’t delivering the expected results and recruiting a range of experienced professionals for key management positions. This elevated ABA’s capabilities to a new level and contributed to big performance improvements.

ABA Cooltrans is an integrated cold chain service & solution provider operating nationwide.

I’ve read great books about communication, like How to Win Friends and Influence People, and the ideas made sense but I just never effectively applied what I had read. I still don’t typically use people’s names when talking to them, although I know Dale Carnegie says it’s a good idea to do so. Conversely, when I was coached by executive coaches in the past, they were always pushing me to go out and discover for myself new ways of communicating. I tried it, failed, tried again, failed again, tried something different, still failed, tried something different again, and eventually it worked.

Once I had found a new way of communicating and it worked, the door was open and there was no turning back: I had experienced what it is to apply that way of communication successfully and it became part of my being. In this way, I discovered two qualities of effective communication: how to communicate very directly with people about whatever needed to be handled, and how to give up avoiding getting right to the point. I got familiar with just letting someone be upset without trying to fix or change them and authentically listen for what is going on for others. Discovering communication like this from my first personal experience, it was like I suddenly unleashed a superpower, and it worked extremely well. I owned it as my own experience, it became part of me and was available for me, not as a list of techniques or tactics I had to remember, but it was simply available for me whenever that way of being would be effective.

This makes sense but…

Most of what investee companies are stuck with and most of the opportunities for breakthrough performance has to do with who people are being in that company. How do they communicate with each other? How to they organize around common goals? How do they empower each other? How do they deal with things that aren’t working? How do they increase the velocity of their actions? How do they be with and listen to their customers? How do they discover and overcome those concerns, excuses, and justifications that are in the way of their performance? Are they being leaders? What space do they create for their team to live and apply the core values every day? Are they being in the world such that the future of their company is alive with possibilities and opportunities so compelling that they are pulled forward to take appropriate actions to fulfill those opportunities and possibilities?

Many readers of this probably think this makes sense, at least theoretically. But when we’re sitting at that Board meeting or dealing with an urgent crisis at an investee company, there may be a temptation to fall back to ways of being and acting that are common sense: we share from what we know, telling them our great ideas, sending out long e-mails, telling them what to do, doing their work for them, or maybe even forcing them or threatening them that if they don’t do something there will be serious consequences. We justify it and think to ourselves “maybe this time it will work, just this once.” But it won’t.

The challenge here is to constantly, in every moment, choose to operate in the realm of being, and relate to others in the realm of being: acknowledging that people are having their own subjective experience — what occurs for them, which their performance correlates with — and giving people the space to create their own possibilities, to have opportunities to practice and struggle, to make their own discoveries, to generate their own ideas and own them, and to persist until they have fully discovered for themselves the experience of doing it well. This does not mean that we are passive investors, rather that we see ourselves as responsible for how things occur for our investee companies, including how we occur for them. We have designed our involvement in such a way that our investee companies take actions to create for themselves ways of looking at things and ways of being which are a fit for their vision to be fulfilled.

Chris Freund is in a meeting at Nhat Tin Logistics office.

Transformation starts at the top and cascades down

Transforming an investee company in the world of being starts at the top and cascades down. Only after the CEO is being — coming from the world of — the core values, might it occur to the senior managers who report to the CEO to choose to try on those core values for themselves. And only after those senior managers are coming from the world of the core values, only then will it become likely for the people who report to them to try on those core values, and so on. In this way, a new culture can cascade down throughout a whole company.

In 2010, MobileWorld was still a small company but was in the process of nearly doubling its number of stores from 37 at the beginning of the year to 69 by the end of the year. The 5 co-founders of MobileWorld saw the need to build a stronger foundation in order to support such a fast pace of growth. They decided to commence a corporate culture transformation project. At first, it started with the 5 co-founders, who spent around 6 months transforming their own ways of being. They practiced listening fully to each other, choosing integrity by honoring their words so that they could fully rely on each other, and choosing to see themselves as fully responsible rather than blaming other people or circumstances. During this phase, they diligently practiced new ways of being and leading. Once they had mastered these ways of being themselves, they rolled it out to the senior management team.

Around 35 senior managers engaged in a 6-month breakthrough leadership program in which they could all discover for themselves new ways of being and leading that were consistent with the culture that MobileWorld was building. After those 35 managers had discovered these values for themselves and were being models of those values, MobileWorld started cascading their core values deeper and deeper in the organization. Ultimately the customer-facing employees, such as the salespeople, came to embody these core values and customers experienced this as MobileWorld having the best customer experience in Vietnam’s mobile phone retail sector.

Concurrently with rolling out this new culture, MobileWorld created an environment of delegating and giving employees the space to make their own decisions, essentially pushing accountability and decision making to the front lines. Rather than headquarters deciding everything, the managers at all levels were fully empowered to make decisions and were held accountable for their decisions.

This worked for MobileWorld because it had created a strong culture that would guide people’s behavior. For example, the whole staff had discovered the value of honoring their words, so they could be relied on to do their jobs. And they all got what it meant to be customer-centric, so they could be relied on to make decisions that were in the best interest of customers. Of course, MobileWorld did provide guidelines to their team members, but MobileWorld’s team were always clear that they had the space to make their own choices as long as they were acting consistently with the company’s core values. Hence, MobileWorld has been successful at delegating very deeply within the organization. This is how the powerful culture of MobileWorld started with 5 co-founders in 2010 and ultimately cascaded down to the front-line employees, resulting in 40,000 employees sharing that culture today.

Transformation always starts from the top. We’ve not yet found any exception to this among our investee companies.

What kinds of actions Private Equity investors can take

There is a contradiction in this article that I am sharing knowledge in what I’ve written, but I’ve asserted that knowledge alone won’t lead to action or impact results. If you are interested in breakthroughs in the performance of your investee companies, I invite you to discover this world for yourself. I’ve discovered that the performance of Mekong Capital, and ultimately the performance of our investee companies, starts with who I am being. Am I being our vision? Am I being our core values? And I being an open space to listen and be with people?

Chris Freund has spent over 23 years living and working in the private equity sector in Vietnam.

There are many openings for Private Equity investors that can lead to altering the being of whole investee companies. The Private Equity investor might invite the relevant people at the investee companies to practice an activity where they aim for a performance breakthrough, struggle through it, not give up, and eventually discover for themselves what is the first-person experience of doing that thing well. Or the Private Equity investor could provide coaching, not in terms of providing solutions or giving ideas, but coaching that gives them the space to inquire into and generate possible solutions for themselves. Or the Private Equity investor might share stories of other companies, in which the listener can see themselves in that story and discover something for themselves, even if just a new possibility. There are many other approaches to cause people to have breakthroughs in the domain of being, and I’m sure there are countless approaches that we have not yet discovered.

So what does it look like for a Private Equity investor to operate in the world of being rather than merely in the world of knowledge transfer? We try to start with empty space and we listen for what is being experienced by the people who work at our investee companies — for example, what is it like to work there, how do we occur for them, and how can we alter the way the world occurs for them in such a way that leads to breakthroughs in performance?

We ensure they create an exciting vision for their future, a vision that has a positive impact and personal meaning for them beyond short-term financial considerations, a future full of possibilities that calls them forward to take action. When they can see themselves in their company’s future, and they all own the same shared goals, they can work together as a team, and we can partner with them to achieve our shared vision for that future.

Rather than giving them lots of ideas, we encourage them to experiment, run tests, try things, or visit other companies, so that they can discover for themselves what works.

When building their corporate culture, we encourage them to practice the core values rather than merely memorize them, until their being and acting are given by the core values.

Whenever a company is off-track on a target, which happens frequently, rather than relating to it as a problem to be avoided, we encourage them to welcome it as an opportunity and analyze it deeply to discover something new and cause a breakthrough. We call this a “breakdown,” and we welcome breakdowns because they lead to an acceleration of the pace of performance improvements.

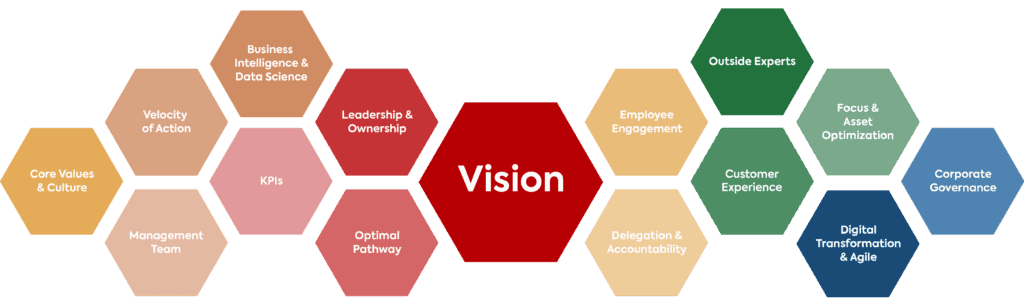

We developed a framework called Vision Driven Investing, which has 15 elements to it. The Vision Driven Investing framework is not forced onto anyone and doesn’t include any solutions. It is essentially 15 competency areas that each have a clear intention (for example, building a strong management team or delegating so that there are no bottlenecks). These 15 competency areas are each its own world of possible ways of looking at things, possible actions, possible experiences.

In these 15 worlds, each company has the space to choose how they look at those, create their own plan for fulfilling that intention, and discover for themselves what works for them. Their occurring of these, and their competency in these, will generally evolve over time: from barely addressing it to mostly addressing it, to fully addressing it, to continuously optimizing it, and ultimately to being best-in-class in that area. We have found that mastery of each of the worlds in this framework is strongly correlated with the performance of our investee companies, and ultimately with the likelihood that a company will reliably fulfill their created vision for their future.

Transformation, Leadership, and Mastery

This is the world of transformation, leadership, and mastery, where ordinary people and organizations, through practice and self-discovery, become extraordinary at what they do. While Private Equity provides a fertile environment for this ontological approach due to the active role played by the investors, we expect this approach can be successfully applied to all kinds of organizations whose employees and stakeholders are authentically committed to the fulfillment of their vision.

Acknowledgements: This is to acknowledge our story-writing coach, Kendall Haven, master story-writer and author of the book STORY SMART: Using the Science of Story to Persuade, Inspire, Influence, and Teach, and Drew Kopp, Associate Professor of Writing Arts at Rowan University, author of the book Speaking Being: Werner Erhard, Martin Heidegger, and a New Possibility of Being Human, for their reviews and contribution to the development of this article.

[1] In this article, I often mention we “discovered” something. I don’t intend to imply that we were the first people or organization to have discovered this, simply that we have discovered it for ourselves, experienced it, we own it as our own, and we are open to the possibilities that arise from what we discovered. Credit is due to our past and current coaches and mentors who have guided us through our own journey of transformation and discovery. These coaches and mentors include (but are not limited to) various people who are or were, affiliated with Landmark Education and its business consulting subsidiary, Vanto Group, and before that, Business Breakthrough Technology. Furthermore, Vanto Group led the leadership/transformation workshops referenced throughout this article.

[2] It would look like this: Hold the two shoestrings up to make sure that the length is the same while still in the shoes with strings placed in each eye hole of the shoe. If the laces are not equal in length before you start to lace the shoes, adjust the shoestrings starting at the top of the shoes or the beginning of tying the shoe. Carry one lace underneath the other after crossing the right lace to the left lace to make an “x” design. Take the string on the right under the middle of the “x” sign. Hold the two strings to the left and right tighten the shoestrings. Make sure that you tighten the shoestrings before tying the shoes. Before you tie a bow with the shoestring you must first tighten the shoe to a level that is comfortable for you. To make the bow, make a loop with the left shoestring. Carry the loop around and under the right shoestring. Repeat the same action with the left string, making a loop carrying it under the right tied loop.

Click below to subscribe to Mekong Capital’s quarterly newsletter.

Mekong Capital makes investments in consumer-driven businesses and adds substantial value to those companies based on its proven framework called Vision Driven Investing. Our investee companies are typically among the fastest-growing companies in Vietnam’s consumer sectors.

In January 2022, Mekong Capital founder Chris Freund published Crab Hotpot, a story about a bunch of crabs who found themselves stuck in a boiling pot. The colorful cover of “Crab Hot Pot,” complete with expressive cartoon crustaceans, looks like a children’s tale at first glance. But as one continues reading, it becomes clear that the work has an important message about organizational transformation, leadership and focusing on a clear vision for the future.

The book is available on Tiki (Hard copy): bit.ly/38baF8a (Vietnamese) and Amazon: amzn.to/3yWunzG (English)

Leave a Reply