From Firefighting to Foundations: Entobel’s Journey to Resilience and Efficiency

[Shared by Alexandre de Caters – Co-Founder of Entobel]

Alexandre de Caters – Co-Founder of Entobel

A Chaotic Beginning: The “Firefighting” Era

The air at Entobel’s factory last year was thick with a mixture of anticipation and, frankly, a palpable sense of chaos. It was an intensely challenging time – a true baptism by fire. We were in the throes of commissioning our new factory – a critical step, but one fraught with unforeseen challenges. As I recall, “We were just opening the plant, ramping up, and we faced all those issues at once. It is somewhat normal for any new factory, but it does not make it any easier.” We aptly called it our “firefighting” era – days defined by immense pressure and long nights wrestling with solutions, yet they were also the times when our team spirit and sheer determination shone brightest.

The initial period was an intense phase of problem-solving. It was not about a flawed approach, but rather the inherent difficulties of bringing a large-scale industrial operation online, especially in a pioneering field.

The Core Challenge: Scaling a Complex Biology

The core challenge, the very heart of Entobel, lies in farming Black Soldier Fly larvae at an industrial scale. Translating a complex biological system from a controlled laboratory environment to mass production presents unique difficulties. We faced issues unprecedented at a smaller scale: How could we effectively manage the immense heat generated by millions, even billions, of rapidly growing larvae? How could we ensure optimal airflow in every single rearing crate? And how could we simultaneously control countless variables – from feed formulation, temperature, and humidity, to density – to guarantee consistent quality and yield in every batch?

Entobel’s products

What made this journey even more arduous was the scarcity of experts in this field worldwide. We couldn’t rely on established knowledge; we had to be pioneers. We had to forge our own path, conduct our own research, experiment, embrace failures, and learn directly from those stumbles.

We learned quickly that if a machine breaks, you can not return it overnight. The process of root cause analysis, design review, finding improvement solutions, and working with suppliers could stretch on for months. We were truly deep in the trenches, “firefighting” daily, navigating the steep learning curve of a new facility. But it was precisely those months of confronting difficulties head-on that forged our resilience and laid the unshakable foundation for Entobel’s development today.

Through unwavering determination and a clear strategic direction, the tide began to turn. The constant “firefighting” gave way to a steady, efficient production rhythm. Today, we stand confident that the most significant initial challenges have been overcome. This stability is not just a feeling; it is proven by impressive numbers: consistent production volumes reaching and exceeding 300 tons of Insect Protein per month, and importantly, our success in controlling and breaking records with production costs below $1,500 per ton in April.

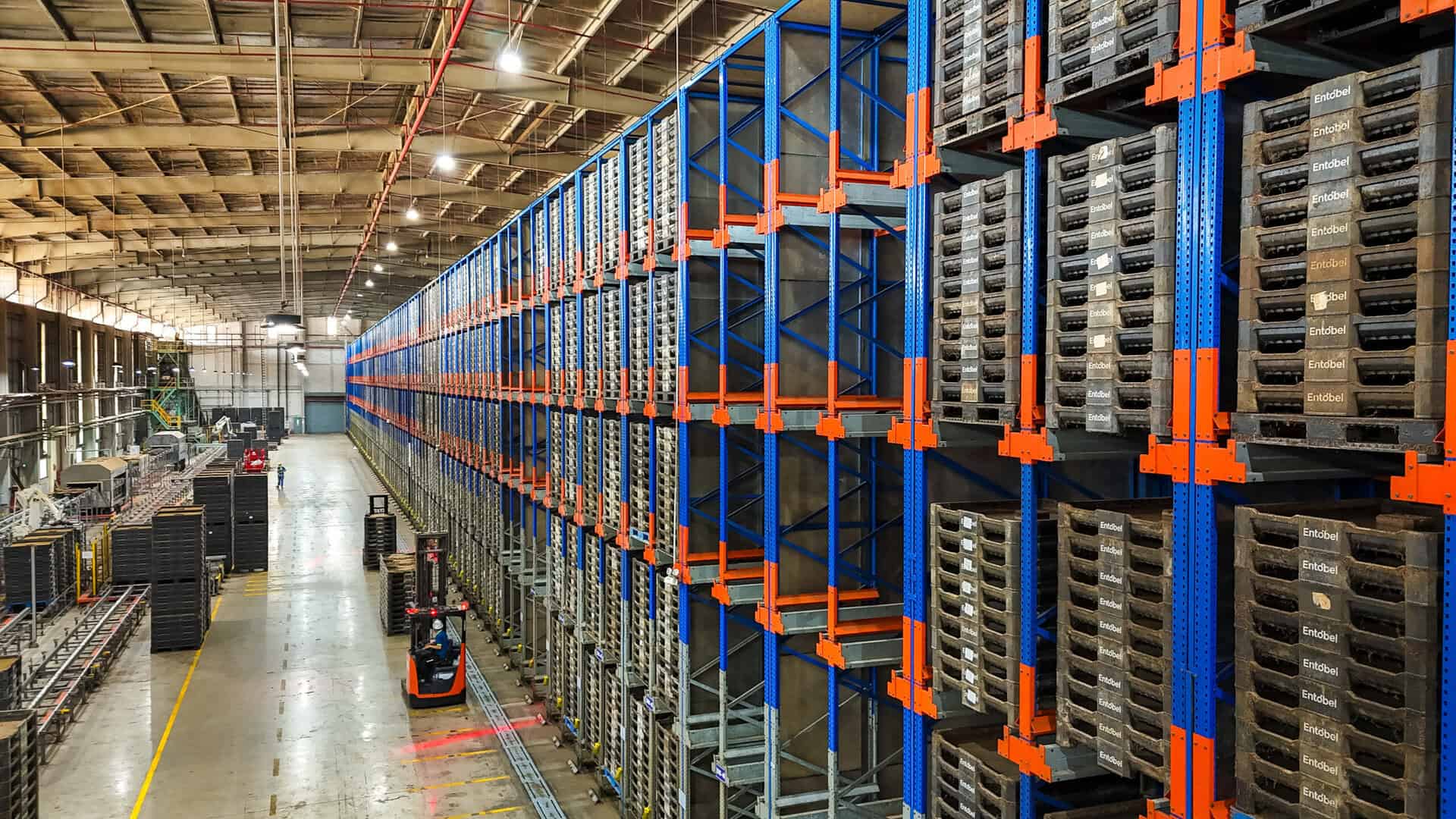

Entobel’s factory

Turning the Tide: From Chaos to Control

This shift was not necessarily a change in how we operated, but a natural evolution as Entobel transitioned from its commissioning phase into a more stable operating phase. With the major hurdles cleared, we could finally shift our energy from survival to optimization. This led to a crucial strategic decision: a laser focus on production costs. In a volatile market where some industry peers have faced difficulties, even closure, due to high operational costs, we’ve realised that cost control is not just about profit – it’s a vital factor for survival, a testament to our sustainability as this is the only way to truly have an impact. “Market prices are largely decided by the market,” I firmly believe, “but production costs are within our control and are the key to enduring.”

From that realization, Entobel’s strategy became crystal clear: to become the leader in cost efficiency. I believe that, in the long run, the business with the lowest, most efficient production cost will be the most resilient. Optimizing costs today builds a lasting advantage and a solid foundation for future growth. The core lesson we learned is to focus on what we can control, rather than expending resources on unpredictable market fluctuations.

This journey was not undertaken alone. The support of our investors and advisors, like Marcel Smits, has been invaluable. With his extensive network and exceptional strategic communication skills, Marcel has helped us connect and powerfully convey Entobel’s vision. His dedication has been a source of strength and has opened many doors for us.

Looking Forward: Scaling With Confidence

Looking ahead, cost optimization remains our top priority, alongside accelerating market development to reach a global scale. We recognise that the insect protein industry is entering a more mature phase, where investors look beyond potential and value proven track records – production volume, costs, and quality. This is where Entobel’s advantage lies, as a company that has demonstrated its operational efficiency through tangible results.

In my leadership role, I feel a palpable sense of momentum and pride. Entobel’s story is a testament to resilience, strategic vision, and the aspiration to rise. And if there is one paramount lesson we’ve learned, it’s the value of practical experience and the philosophy of ‘testing as early as possible’. It is this spirit that has guided us through the challenges and gives us the confidence to affirm our position in the global insect protein industry.

Leave a Reply