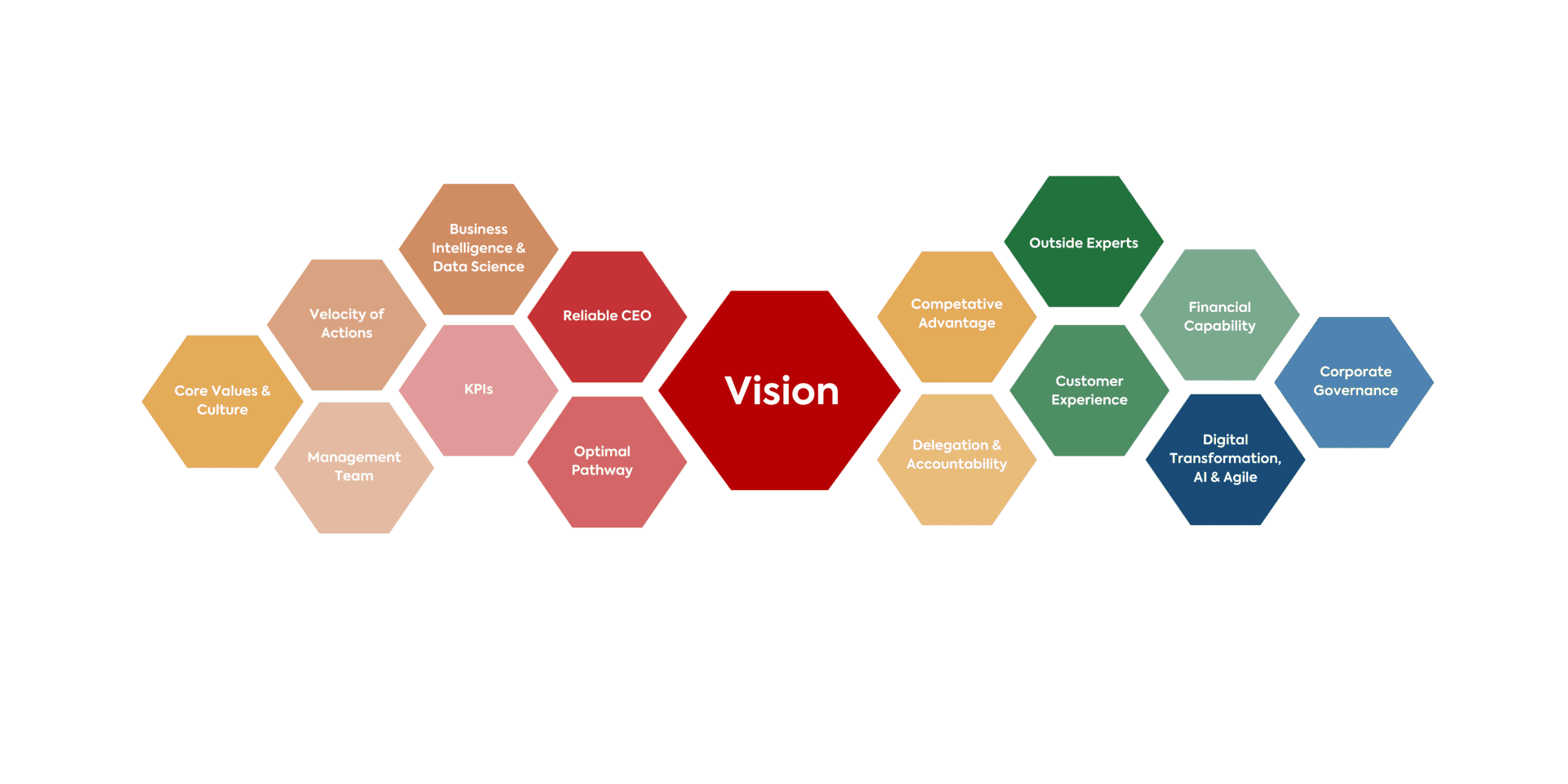

In a Private Equity context, our partnership with each investee company starts with our shared vision for the future of that company, not an aspirational vision but a committed vision, measurable and actionable goals that paint a clear picture of what the company’s future looks like by a specific time in the future. This is not to motivate people, nor for marketing purposes, but rather so that the management team, Board of Directors and other key business partners are working together towards common objectives in the future. This is why we call our framework “Vision Driven Investing”. It starts with a vision which is the paramount goal of our partnership.

The Vision Driven Investing framework is regularly reviewed and refined, at least quarterly but typically more frequently based on careful analysis and insights about what’s working best, while removing the parts that are not working reliably. The framework is back-tested against our past investments, and especially we take into account our current portfolio, to ensure it is strongly correlated with what has led to the best performance among our investments until now. For example, we evaluate each of the 15 elements of the Vision Driven Investing Framework against measures such as EBITDA Growth and Gross IRR, considering both the slope and r2 of the relationship. This data based testing approach is elaborated in the 2022 white paper co-authored by AISIA Research Lab and Mekong Capital: Vision Driven Investing: A Reliable Framework for Breakthrough in Investment Performance.