East Asian investors, particularly from Singapore, China, South Korea, Japan, and Taiwan, account for approximately 70% of Vietnam’s FDI. Singapore leads with a 27% share, followed closely by other regional giants. Global corporations are deeply embedded in Vietnam’s economy. For instance, Samsung’s $23.2 billion investment has made Vietnam a key production hub for its smartphones, contributing $54.4 billion to Vietnam’s exports in 2024. Similarly, Apple suppliers like Foxconn have expanded operations, producing significant shares of iPads and AirPods, reinforcing Vietnam’s critical role in global value chains.

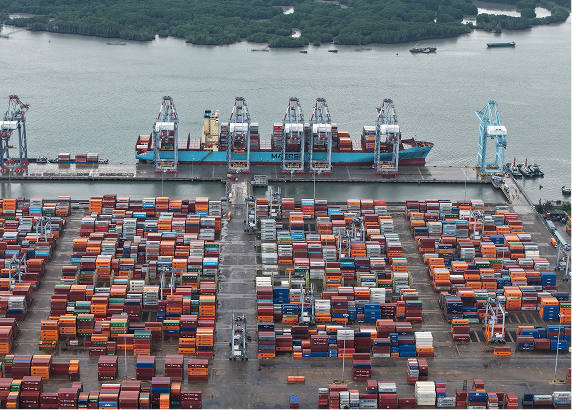

Vietnam’s integration with East Asia, encompassing 70% of its FDI, trade, and economic exchanges, provides a strong foundation for resilience. Despite U.S. tariffs peaking at 46% in early 2025 before easing to 20%, inflows from Japan, Korea, and China remain robust. Landmark projects, such as the $8 billion Lao Cai-Hanoi-Haiphong railway and the $200 million Vinh Phuc superport, highlight this commitment.

The Regional Comprehensive Economic Partnership (RCEP) further amplifies Vietnam’s advantages, offering tariff-free access to markets representing 30% of the global population. In 2025, Vietnam’s exports to China reached $69.36 billion, underscoring deepening regional ties. Local firms, such as Viettel with its $130 million border logistics investment, are also strengthening these supply chains, cementing Vietnam’s position as a central hub in East Asia’s economic ecosystem.