A New-Age Corporate Culture Transformed a Fund Manager’s Fortunes

Author: Tom Redmond and Nguyen Kieu Giang from Bloomberg Market

This article is also available in Japanese and Korean.

———

Chris Freund had reached one of life’s nasty crossroads, and he was in despair. Six years earlier he’d set up a small private equity firm, Mekong Capital Ltd., in Ho Chi Minh City. Now it was 2007, the firm was a mess, riven by gossip and office politics and a lack of discipline, and the companies it had invested in were just not performing the way they should. “I never was going to give up on Mekong Capital, but I was about to give up on myself,” he recalls. “I didn’t quite know what to do.”

His search for answers took him back to the 1990s, when he was studying psychology at the University of California at Santa Cruz. There, in a stretch of the West Coast that still bore the imprint of 1970s New Age experiments and lifestyles, he’d come into contact with an organization called Landmark Worldwide. Founded in 1991 as the continuation of Werner Erhard’s est (for Erhard Seminars Training) movement, Landmark specialized in personal-development programs. Freund even took one of its courses at the time. He was impressed but over time gradually forgot about it.

Mekong Capital founder, Chris Freund (Photographer: Maika Elan for Bloomberg Markets)

Until now. As he wrestled with his predicament, Freund remembered hearing that Landmark had branched out to Singapore, so in June 2007 he flew there to enroll in a three-day Landmark Forum course, which costs S$1,260 ($921) today. Current courses offered by Landmark, which include The Illusion of Someday: Rethinking Possibility and The Pervasive Influence of the Past, suggest a cross between Socratic interrogation and self-help motivational psychology—the sort of group therapy that would enthrall some people and repel others. Freund was plainly one of the former. “What I got at the end of those three days was life-changing, and I knew it,” he says. “I felt very elated and excited.”

Six months later, fortified by his new sense of purpose, Freund called in a team of trainers from Vanto Group, the consulting subsidiary of Landmark. When they landed, Mekong Capital’s 50 or so employees didn’t know what hit them. “I basically signed up our whole team to do this program in Vietnam without even telling them why we’re doing it,” Freund says. The move didn’t go down well. Some employees took to the training and would later become stars of Mekong Capital. Others found it unpalatable; more than half of Mekong Capital’s staff would quit over the next two years.

Undeterred by the initial resistance, Freund pressed ahead. He and his employees created a set of core values to guide their behavior. They expressed them first in plain English, but words like “integrity” meant different things to different people. So Mekong Capital designed its own vocabulary. To the uninitiated, “beautegrity” sounds like gibberish, but at Mekong Capital it’s one of eight core values emblazoned on wall posters and is defined as “honoring our word so that everything works; working together as a unified powerful force.”

When Mekong Capital hires new employees, it’s more interested in whether they’re a good fit with this culture than in what university they went to or if they’ve been certified as a chartered financial analyst. Mekong Capital lives by its code, says Chris Shayan, the company’s director of business engineering. “It’s not just on the wall,” he says. That may be, but how would this weird amalgam—Age of Aquarius meets Wall Street meets communist Vietnam — turn a broken PE shop into one that actually worked?

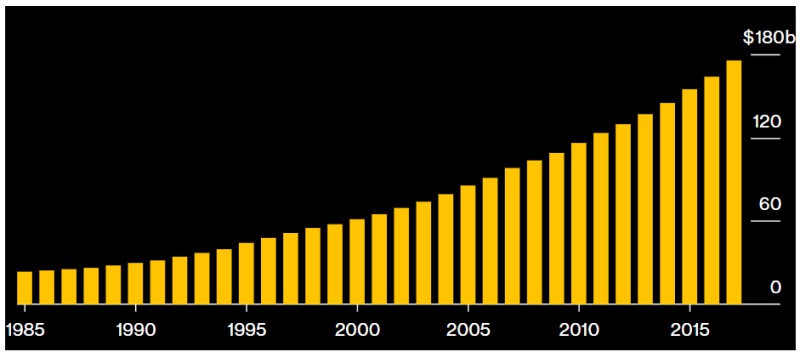

Vietnam Real GDP

In 2010 dollars

Source: {WRGDVIET Index}

A child of 1970s America, Freund tried on several different religions even as a high school student. He was born Jewish but became a Buddhist in high school and pursued his interest in the religion during college, traveling to India and on to Thailand. From there, Freund set off in 1992 on a backpacking trip into Vietnam. He fell in love with this war-scarred nation battling to find its place among Asia’s fast-growing emerging economies. “The people were so friendly and kind of optimistic,” he says. “I wanted to come back.”

The lifting of the 30-year-old U.S. trade embargo on Vietnam two years later paved the way for Freund’s return. After graduating from UC Santa Cruz in 1995, he took a job with Templeton Asset Management Ltd., the renowned emerging-markets investor, and set up Templeton’s first office in the country. The asset manager’s joint-venture investments with state-owned enterprises didn’t pan out as expected, so Templeton closed the office after three years. Freund transferred to Singapore and stayed with Templeton until he quit in March 2001.

Within a week he was back in Vietnam. In his mind, he’d never really left, nor had he abandoned his yearning to start a PE firm there. Before long, he set up Mekong Capital, named after Southeast Asia’s longest river. Mekong Enterprise Fund I debuted in May 2002. It was tiny, at $18.5 million, and backed by development finance institutions, which provide financing to help boost economic growth in countries such as Vietnam. From the outside, the firm, which had grown from 12 to 50 people by 2007, looked successful.

But on the inside, Freund says, there was no sense of personal accountability. Portfolio managers were making excuses—playing the victim, blaming others—when their investments didn’t perform as planned. “Companies kept not achieving their targets, and a lot of them weren’t even growing,” Freund says. What’s more, according to a Harvard Business School study, investors in Mekong Capital’s funds “were questioning whether the team had the depth necessary to structure investments, add value, and achieve optimal exits.”

“It was a very emotional time,” says Freund, 46. “There were a lot of people blaming each other or just getting upset. Sometimes it was me getting upset. Sometimes it was someone else.” Though he was learning the language and would later marry a Vietnamese woman, Truong Ngoc Phung, Freund still felt like an outsider. It’s not that business opportunities were hard to find. The communist state had been moving away from a highly centralized command economy since the 1980s. The private sector, still young, was fertile ground for PE investors. But he was beginning to feel, as he puts it now, “that it’s impossible, that I’ll never understand Vietnamese people.”

That was when Freund, desperate for inspiration, turned to Landmark. Its training is designed to get participants to break down the “stories,” or preconceptions, they have about themselves and to take responsibility for their behavior and their relationships with other people. Freund says the course he took in Singapore showed him what was wrong in his life: that he was playing the victim, that he needed to be the agent of his own change, to be, in the language of Landmark, “cause in the matter.”

Freund says he became a different person. Before Landmark, he would react emotionally to things, he says; with time he became much less reactive and more focused on the facts. So much so, says one investor in Mekong Capital who didn’t want to be quoted by name, that the firm’s founder can appear to be “borderline autistic.” Freund has heard this before. “He’s not the only person who has that assessment,” he says. But this has nothing to do with his genetic makeup, he says; he learned to change his behavior through Landmark’s training and coaching.

“It’s not a coincidence that a lot of really successful companies that have a strong culture are often called cultlike”

The next step for Freund after his return from Singapore was to replicate his transformation among his co-workers at Mekong Capital. “Freund believed their current problem was not due to a lack of technical knowledge,” according to the Harvard study published in 2010, “but was rather a consequence of imperfect internal management and corporate culture.” In retrospect, Freund says, he could have done a better job of preparing the employees for what was coming. “I didn’t make the effort to ensure they were on board.”

One of the employees who would leave Mekong Capital was Duong Do Quyen, who sat on Mekong Capital’s board of directors and was portfolio manager for one of its funds. Quyen resigned toward the end of December 2007 but stayed on for about six months until the company found her successor. “I was not totally in agreement with him,” she says of Freund. “The new philosophy was trying to put everyone into the same way of thinking.” Quyen, who now works for Dragon Capital in Ho Chi Minh City, says she took some of the Vanto training even though she had resigned. Her verdict: “It’s a little too religious. It’s a bit too extreme.”

Not for Freund and his co-believers. “That’s what’s most attractive to me,” Chad Ovel, a partner who was chief executive of one of Mekong Capital’s portfolio companies before joining the firm in 2013, says of the strong corporate culture. Mekong Capital, he says, “knows exactly what it is. And more importantly, when we go out and meet pipeline companies, they know who we are.”

Chris Freund (Photographer: Maika Elan for Bloomberg Markets)

Freund says building and enforcing a corporate culture doesn’t happen by accident. “It’s a very deliberate effort,” he says. “If you look at religions, they also have their own, what people might call, jargon, and it means something to them, which doesn’t make much sense to outsiders. We’re doing that. But our goal is not any religious goal.” At the same time, Freund says, “It’s not a coincidence that a lot of really successful companies that have a strong culture are often called cultlike.”

The firm’s strictly defined corporate culture of teamwork and personal responsibility is not unlike what Ray Dalio, with his unconventional management style and his belief in the importance of understanding one’s “ego-barrier,” has inculcated in his employees at Bridgewater Associates LP, the world’s largest hedge fund. It could be argued that Mekong Capital doesn’t go as far as Bridgewater, which records conversations in its offices and doesn’t allow its employees to speak in meetings about colleagues who aren’t present.

At Mekong Capital, Freund says, focusing on direct communication is paramount. You don’t sugarcoat anything, but you also don’t make others feel like they’re in the wrong. To reinforce this and other aspects of Mekong Capital’s culture, staff members are encouraged to hold “storytelling” sessions in which they talk about how company values affect their personal or work experiences and to write about them on the company’s internal blog, with some entries later becoming publicly accessible.

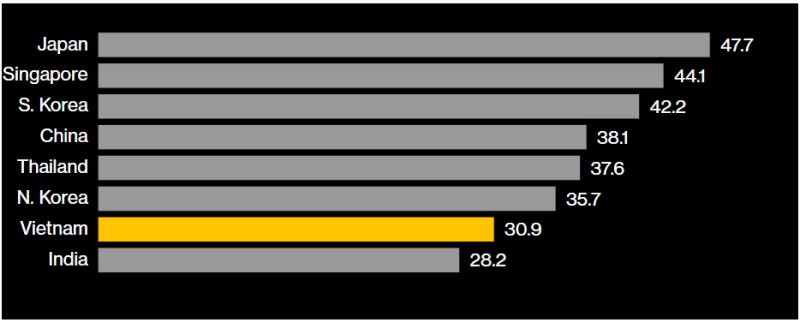

In some ways, Mekong Capital, which now employs 37 people, is a typical emerging-market PE fund. It raises money from development finance institutions, family offices, endowments, and other investors to put into small Vietnamese consumer companies with growth potential. The Southeast Asian nation is ideal for this strategy. Its economy has been growing at more than 5 percent a year since the turn of the century. It’s not as dominated by large corporate groups as other Southeast Asian countries are, so homegrown companies are still small and industries fragmented. The median age of Vietnam’s 97 million people is just over 30, and the consumer class is expanding quickly: In the sprawling city many still call Saigon, shopping malls are proliferating, global brands are everywhere, and more and more cars jostle with motorbikes in chaotic traffic.

Nation’s Median Age

As of 2018

Sources: {JAPNMABS Index}, {SGPRMABS Index}, {SKORMABS Index}, {HCNAMABS Index}, {THLDMABS Index}, {NKORMABS Index}, {VIETMABS Index}, {NDAIMABS Index}

What distinguishes Mekong Capital is not just its employees’ near-apostolic adherence to the firm’s core values but also that it takes its bespoke philosophy—which it calls Vision Driven Investing—and persuades the companies it backs to embrace it as well. Mekong Capital even has a hand in hiring about 75 percent of the senior managers who go to work at companies it invests in. The VDI regime essentially involves setting a target for where a company wants to be in five to eight years. Mekong Capital and the company then meticulously track the steps needed to get there, inviting “breakdowns” that can be used as lessons learned en route to “breakthroughs.”

Mekong Capital’s approach of “declaring a big future” for companies goes well beyond what he learned when getting his MBA at the University of Chicago, Ovel says. “There was nothing in the curriculum about using future-based language to pull for new actions or about the importance of authentic listening or direct communication in leadership teams as a pathway to increasing the velocity of results,” he says. And the companies have taken that approach on board. Bloomberg Markets interviewed executives at eight of Mekong Capital’s investments. Almost all spoke about themselves or their companies using Mekong and Landmark’s distinctive vocabulary.

The kind of investment aftercare practiced by Mekong Capital matters, says Menno Derks, Amsterdam-based partner and managing director for fund investments at Kitchener, Ont.-based Sarona Asset Management, an investor in Mekong Capital.

Take Mobile World Investment Corp., a company in which Mekong Capital invested in 2007, the year of Freund’s transformation. Mobile World had only seven stores then and was co-owned by five friends. Mekong Capital helped the company recruit three key people in 2008, including the current CEO and two board members. It introduced Mobile World to Vanto, which helped the company strengthen its culture. It also brought in an outside expert, Bob Willett, former co-CEO of Best Buy Co., the U.S. electronics retailer. Willett, who is still on Mobile World’s board even after Mekong Capital sold its shares, helped make the company more customer-driven, Freund says.

Today, Mobile World, which sells mobile phones, electronics, and groceries, has more than 2,000 outlets and is one of the country’s biggest public companies. When Mekong Capital finally exited in January 2018, its return was more than 50 times its original investment. They helped us with “so many things,” says Nguyen Duc Tai, Mobile World’s chairman and co-founder.

Companies like Mobile World benefit hugely from Mekong Capital’s advice, Derks says. “We are a strong believer that all those midmarket companies don’t only need money to grow,” he says. “They need really active support. And we really thought that was a pretty unique selling point of Mekong Capital.”

“I never was going to give up on Mekong Capital, but I was about to give up on myself. I didn’t quite know what to do”

Did Mekong Capital’s transformation do the trick? Freund says it did, and to make his case, he allowed Bloomberg Markets to see the firm’s investment results. After those stumbling early years, the performance of Mekong funds surged. The gross internal rate of return on investments from Mekong Enterprise Fund II, which exited its final investment in 2018, was five times higher than its predecessor, which sold its last portfolio company in 2013. On average, Fund II achieved a 6.5-fold return on its original investments in companies in the fund.

More recently, Mekong Capital has been working with Pharmacity JSC, one of the companies in Mekong Enterprise Fund III. Pharmacity aims to open 1,000 drugstores in Vietnam in 1,000 days running up to November 2021. Mekong Capital works with companies such as Pharmacity to map out key progress indicators, build technology infrastructure, design bonus systems, and so forth. But that’s only part of it. “We’re really in the game of helping companies define who they are, what they want to be, how they want to be, and ensuring that they embed a corporate culture very early on before they scale too much,” Ovel says. “This is not a theoretical approach. Everything we do is based on what worked in the past.”

It worked for Chris Blank, the U.S.-born founder of Pharmacity, who at Mekong Capital’s suggestion went through the Vanto training. “It changed my life,” he says. “If there is one thing that I’d say I’m really thankful to Chris [Freund] for, it’s turning me on to that.” Blank, who was orphaned early in life, says he experienced constant feelings of worthlessness before a light-switch moment during training when he realized he could change his perception of himself. Visit Pharmacity’s main office in Ho Chi Minh City and the first thing you’ll see on the wall is a big poster proclaiming its vision and an electronic counter keeping tabs on the number of stores the firm has opened toward its expansion goal.

In interviews, limited partners who’ve invested in Mekong Capital make it clear they’re not expecting another 50-times return like with Mobile World. But Freund and his colleagues say some of the new investments have great potential. They say the most promising companies in Fund III, which raised $112.2 million at its final close in May 2016, are Pharmacity and F88 Investment JSC, which makes smallish loans to borrowers using their motorbikes as collateral.

What matters is that Freund has instilled values in Mekong Capital that are reliable and durable drivers of success, says Sarona’s Derks. “We’re a satisfied investor with Mekong Capital,” he says. “We don’t invest with the expectation that we’ll see another Mobile World.”

Featured in the June / July 2019 issue of Bloomberg Markets.Cover artwork: Zohar Lazar for Bloomberg Markets

Nguyen Thi Minh Giang, 35, recalls what it was like when she got a job offer from Mekong Capital in 2010. At the executive search firm where she worked at the time, friends and colleagues cautioned her that Mekong Capital was like a cult, “a weird religion,” she says. “They told me, ‘Minh Giang, you are crazy. Why would you join Mekong Capital?’ ”

Minh Giang decided to keep an open mind. She was Mekong Capital’s director of talent and culture, and her faith has been repaid. She was able to pay off her mortgage and can now support her extended family. She’s taken Mekong Capital’s philosophy to heart. Shortly after her interview with Bloomberg Markets, Minh Giang was due to travel to Las Vegas to take a look at Zappos.com, the online shoe and clothing retailer that enshrines “Create Fun & A Little Weirdness” as its Core Value #3, to see what lessons she could learn from another strong corporate culture.

Minh Giang and Freund agree that the Mekong Capital way is, as he says, “not for everybody.” Freund doesn’t even mind being asked if Mekong Capital isn’t a little bit like a cult. “In a way it’s kind of a compliment to me because, yeah, I think we’ve built a strong culture,” he says. “And I’m proud of it.”

Redmond covers equity markets from Singapore. Nguyen is a reporter in Hanoi.

May 15, 2019

Copyright purchased

Click below to subscribe to Mekong Capital’s quarterly newsletter.

Mekong Capital makes investments in consumer-driven businesses and adds substantial value to those companies based on its proven framework called Vision Driven Investing. Our investee companies are typically among the fastest-growing companies in Vietnam’s consumer sectors.

In January 2022, Mekong Capital founder Chris Freund published Crab Hotpot, a story about a bunch of crabs who found themselves stuck in a boiling pot. The colorful cover of “Crab Hot Pot,” complete with expressive cartoon crustaceans, looks like a children’s tale at first glance. But as one continues reading, it becomes clear that the work has an important message about organizational transformation, leadership and focusing on a clear vision for the future.

The book is available on Tiki (Hard copy): bit.ly/38baF8a (Vietnamese) and Amazon: amzn.to/3yWunzG (English)

Leave a Reply