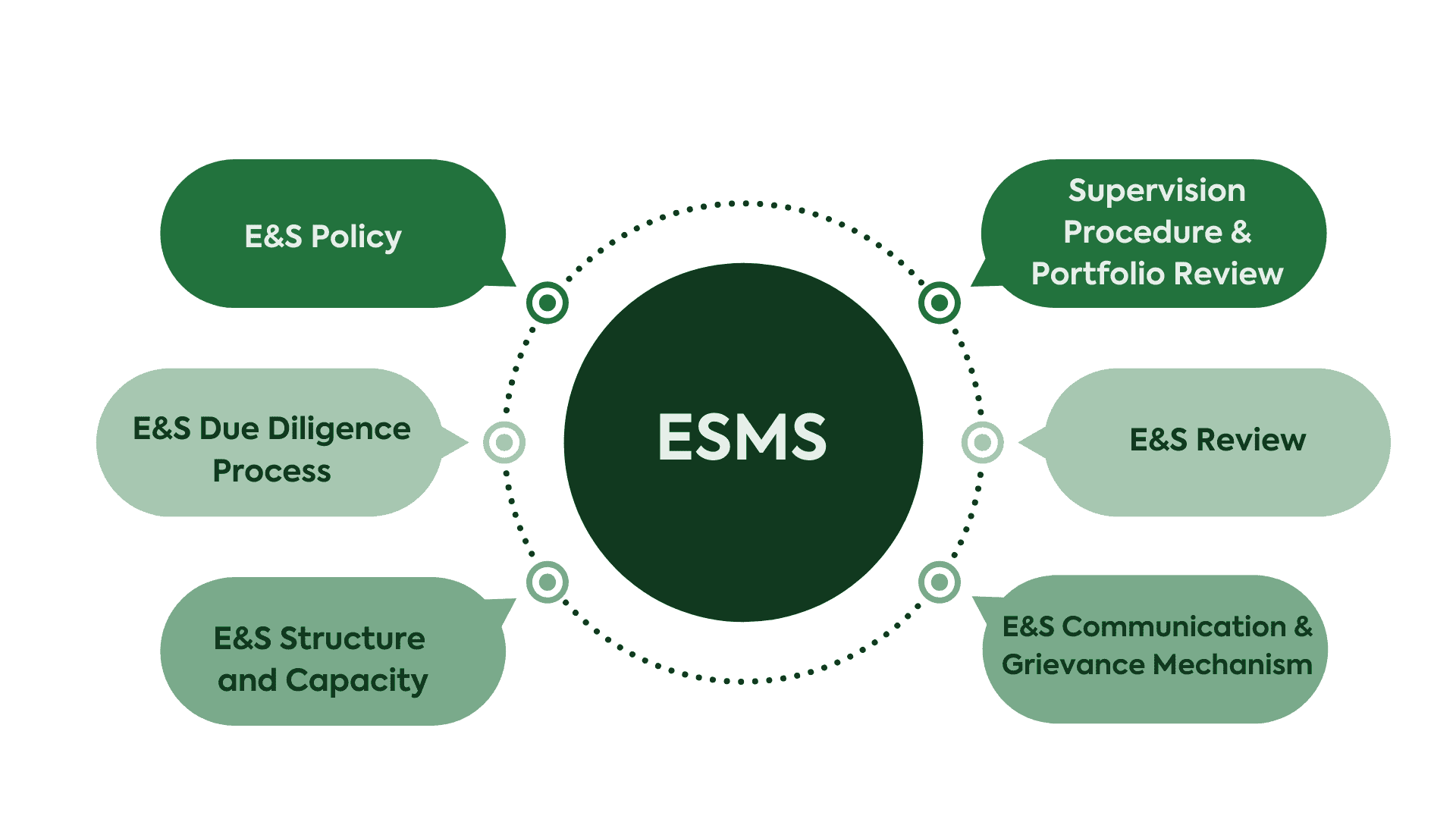

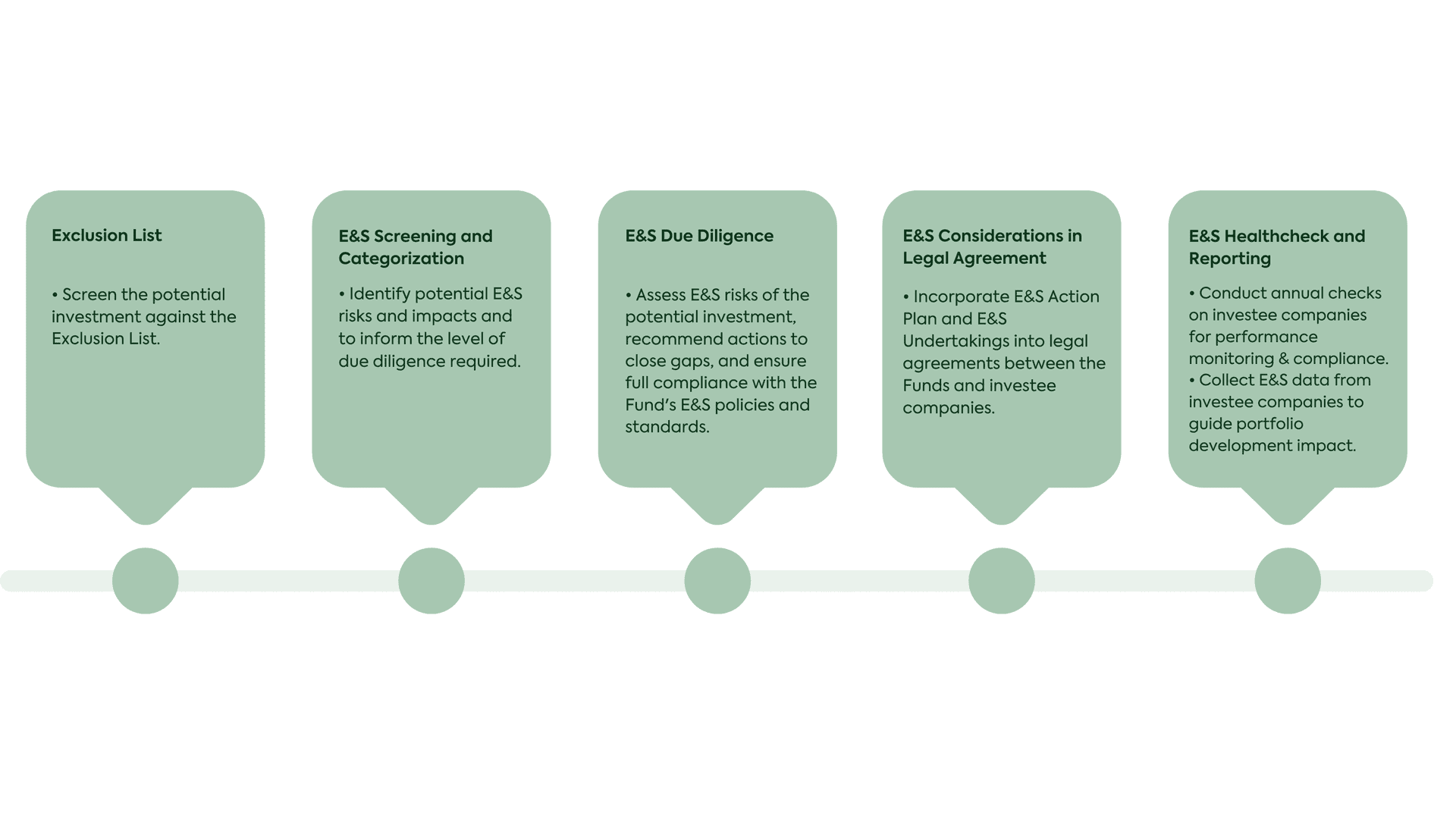

Starting from our awareness and comprehension of development sustainability issues and the goal of generating positive impacts through our investments, and aligning with the commitments we have with our investors and portfolio companies, Mekong Capital has acknowledged the importance of environmental and social aspects in our investment decision-making process.

We also prioritize these aspects in our ongoing engagements with portfolio companies to establish lasting value for the businesses.